Experienced – Collaborative – Professional

stamp duty & stamp duty land tax

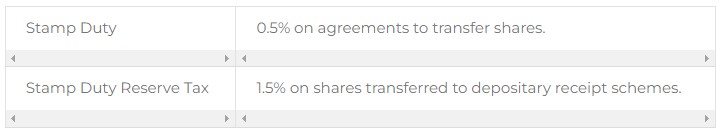

stamp taxes

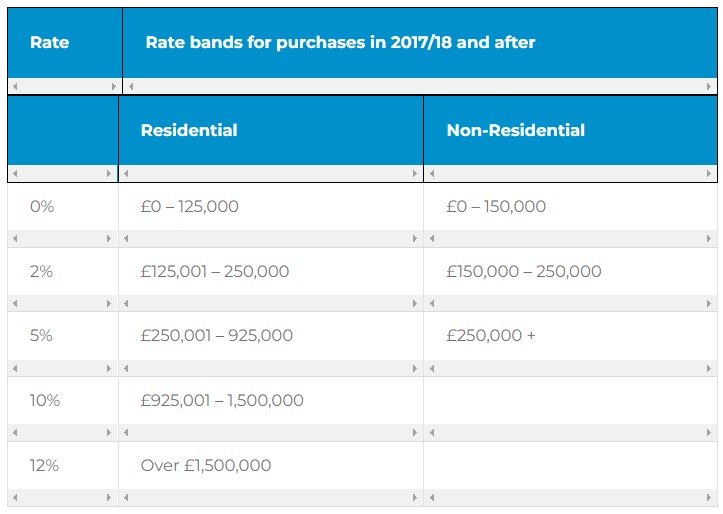

stamp duty land tax

Stamp duty paid at the relevant rate for each band.

Additional 3% charged on purchase of additional residential property.

Companies pay 15% on purchases of residential property values at over £500,000.

No stamp duty on first £300,000 for first time buyers if total property value under £500,000.

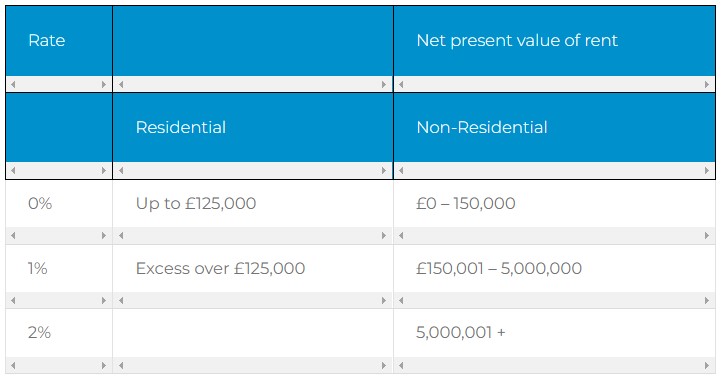

leases

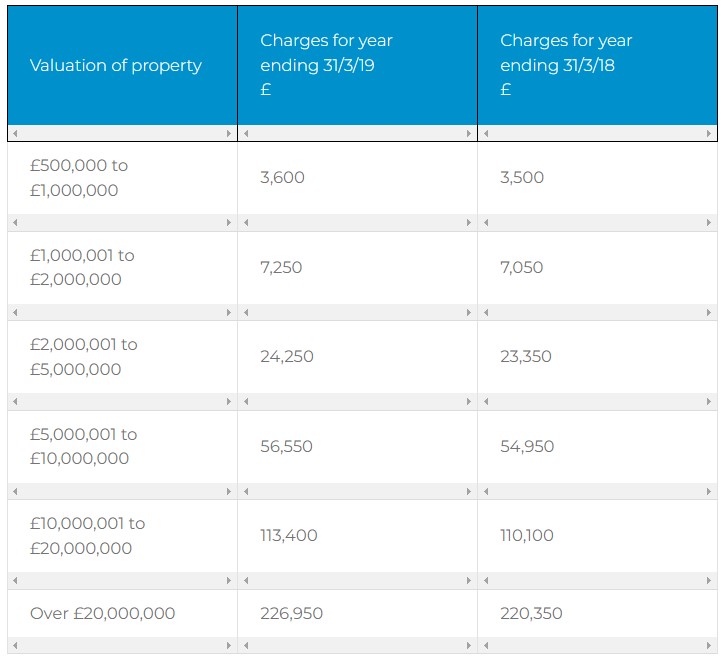

annual tax on enveloped dwellings (ated)