Experienced – Collaborative – Professional

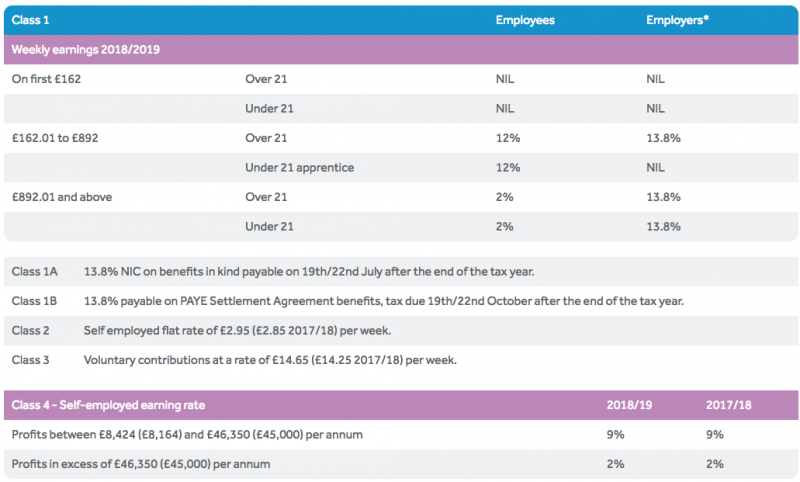

National Insurance

* EMPLOYMENT ALOWANCE available from 6 April 2015. Reduction in Employer’s NIC of £3000 (maximum, or limited to actual Employer’s NIC, if lower) for the year.

Apprenticeship Levy: From 6 April 2017, employers will be required to pay the Apprenticeship Levy. The Levy is set at a rate of 0.5% of an employer’s annual pay bill and will be collected through the PAYE system. The pay bill is the total amount of earnings liable to employer’s Class 1 NIC, including earnings below the secondary threshold. Where the age-related secondary percentage of MC is 0% e.g for employees under the age of 21, such earnings are included in calculating the pay bill.

Employers receive an annual allowance of £15,000 to offset against payment of the Levy, and therefore the Levy will be payable only by employers who have to pay bilis in excess of £3million per year. Where two or more companies are connected, the allowance is spread between the companies.