As the dust settles on ‘liberation day’ with markets finally recovering, I felt it useful to look at investments in light of the new world we find ourselves in.

What has been clear since Covid (where has that time gone???!) is that the markets continue to be volatile. For an investor 20 years ago it was unusual for the market to move more than 0.5% in a day. Now it is unusual if it doesn’t!

This volatility can be unsettling for investors so it’s important to remember why we invest and what can happen if we get it wrong. The first thing we must remember is that investments are long term in nature, by this we mean at least 5 years. This isn’t just until you retire but for most of our clients this is their whole life. Yes, things may change but even somebody aged 60 could be investing for at least another 25 years.

The net impact of investing is still ‘the longer you invest the more likely you are to make money’, even if that journey is more volatile in the short term. This ethos hasn’t changed, the volatility in the markets has.

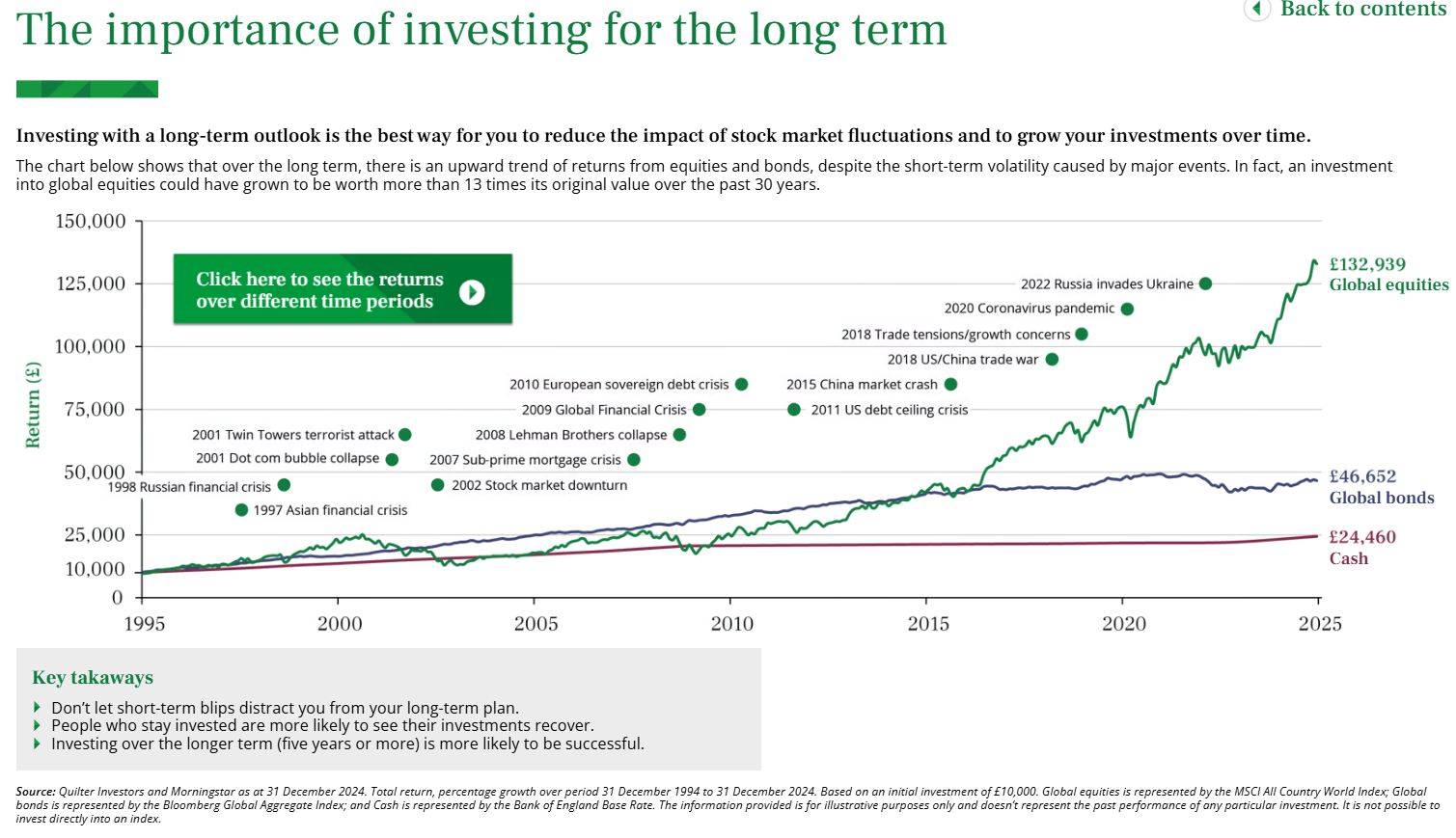

The chart below shows that despite some intense periods of volatility, the market continues to grow, albeit it may feel uncomfortable and upsetting in the short term.

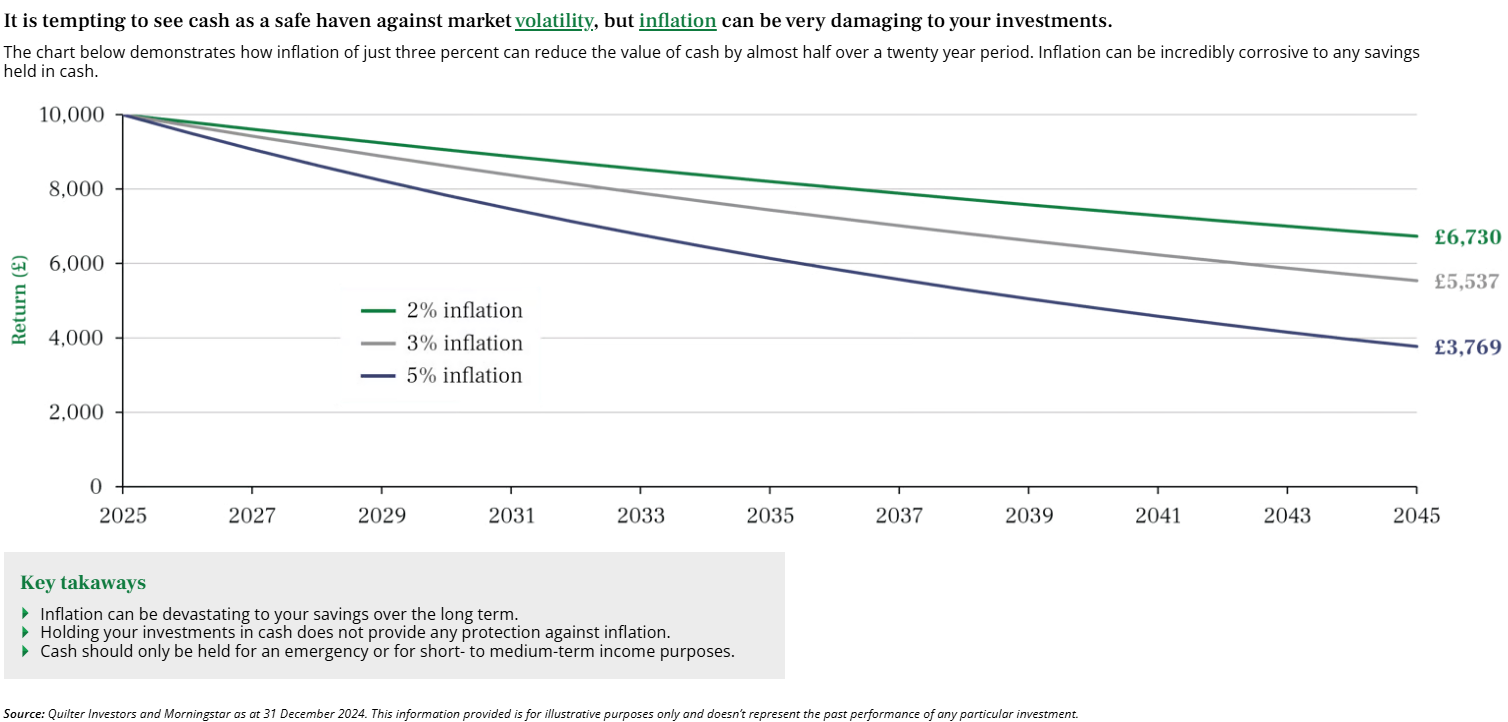

So, what can we do to make the journey less bumpy? The obvious answer and a question we often get is ‘I should just stay in cash’ and not invest in markets at all. This is rarely a viable long term solution as the above chart shows. Yes, cash has done incredibly well over the last few years with higher rates, and you would never see any falls in value. What a lot of people don’t consider is the impact inflation has on the real value, or purchasing power of your money. Yes, by investing in cash you will guarantee your money doesn’t go down but of course, it could in real terms if inflation is more than the interest you receive!. This means that in the long term the buying power of your money will be eroded over time.

Take a look at the table below.

As you can see, the buying power of your money will fall. Short term interest rates have been (and still are) higher than inflation so the real value can be safeguarded, but this has rarely been the case over the long term.

Cash will always have a place in any portfolio but will rarely be the long-term solution. Investing is certainly the best way to grow your wealth in real terms and to do that you must beat inflation. But how do we manage the risks in an increasingly volatile marketplace?

There are two golden rules that always hold when investing.

- Diversification

- Time in the market, not timing the market

Diversification

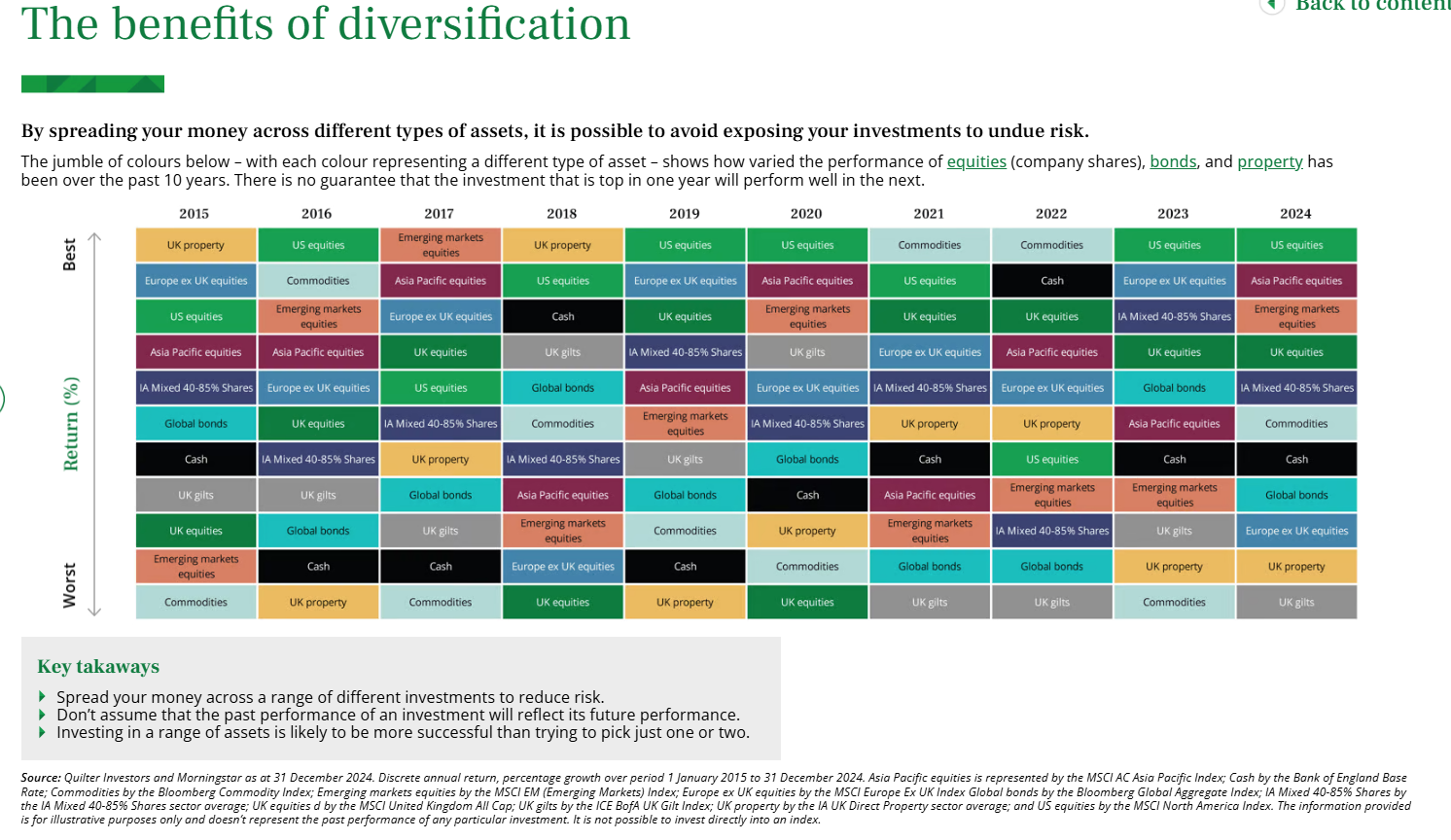

It is important to not have ‘all your eggs in one basket’. This doesn’t mean having several different fund managers or different providers but is more focused on managing the risks within a portfolio. At Willow we believe this is best handled by one manager who can see all the risks/opportunities and exposures within a client portfolio and is why we favour Multi Asset Investment. This is where professionals manage the risk within a portfolio and decide on where and how to invest. The chart below shows the importance of this.

Each coloured square shows a particular asset class and its performance in each year. As you can see, rarely does one particular asset consistently outperform. It is important to have a blend of assets across asset class, geographical region and sectors. Effective management of this will undoubtedly help ‘flatten’ the line and take out some volatility.

Time in the market, not timing the market

The other golden rule is to remain invested in the market. When things are going wrong, it is only human nature to want to change something or do something different to get a different result. The hardest thing to do is trust the investment manager and do nothing.

This is often the best thing to do. As we have seen, markets recover and panicked, emotional decisions rarely work well. Indeed, where advisers have often delivered the most value is in talking people ‘off the ledge’ and helping them not to panic. In volatile times, you are only looking at changes in value, not losses or gains. You turn the situation into losses or gains when, and only when, you sell.

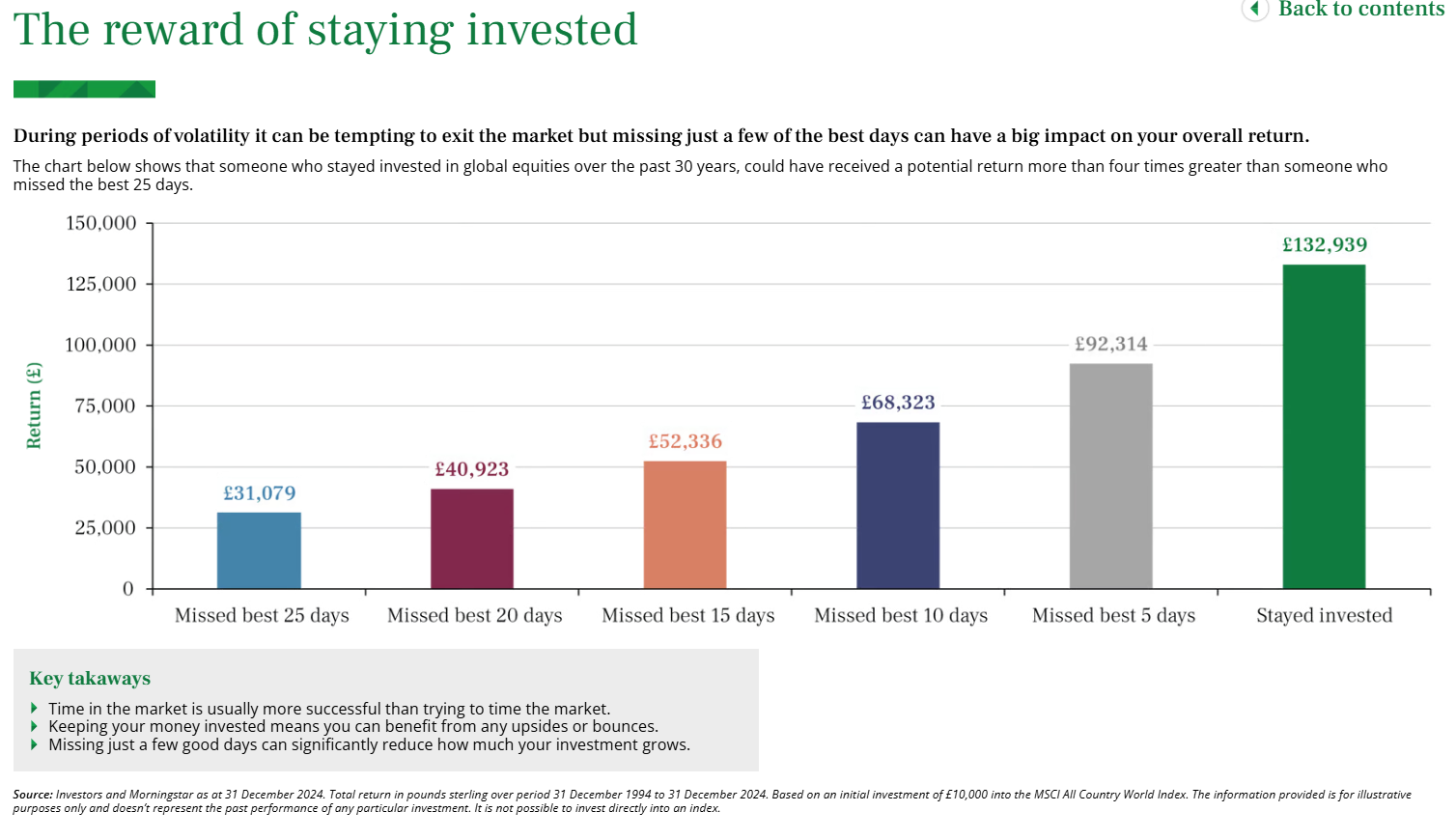

Following a sudden dip in the market, the recovery or biggest bounce oftens happens fairly quickly and missing this can have a huge impact on someone’s portfolio. If you sell out and miss the bounce, you are in effect locking in your losses. This is illustrated below.

If you had invested £10,000 in global equities for the last 30 years (10,950 days), you would have grown your money to £132,939. This shows the importance of ‘time in’ the market. If you had tried to time the market and missed just the 5 best days over this time period (0.05% of the time) your fund would have only been worth £92,314. If you had missed just the 25 best days (0.22% of the time) your fund would have been worth £31,079. For such a small period of time this obviously has a massive impact on the underlying value of your investments.

If we find ourselves in increasingly volatile times the principles of investing will remain, even if it makes us feel uncomfortable in the short term. The only prices that matter are the ones you buy at and the ones you sell at. Downward changes in value, as uncomfortable as they may feel, are only ‘on paper’ and if you hold to the basics, remember that investments are long term, you will make money.

These core truths do not change. Investing will over the long term will outperform cash in real terms and deliver real value to investors.

Leave A Comment