Experienced – Collaborative – Professional

Inheritance Tax Advice

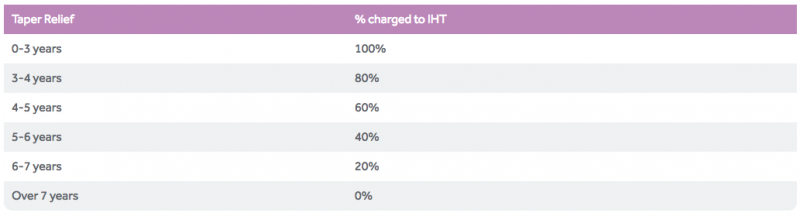

Gifts made to individuals and certain types of trust are potentially exempt, provided the donor survives for seven years. If they die within that period taper relief (below) is available if the gift is taxable.

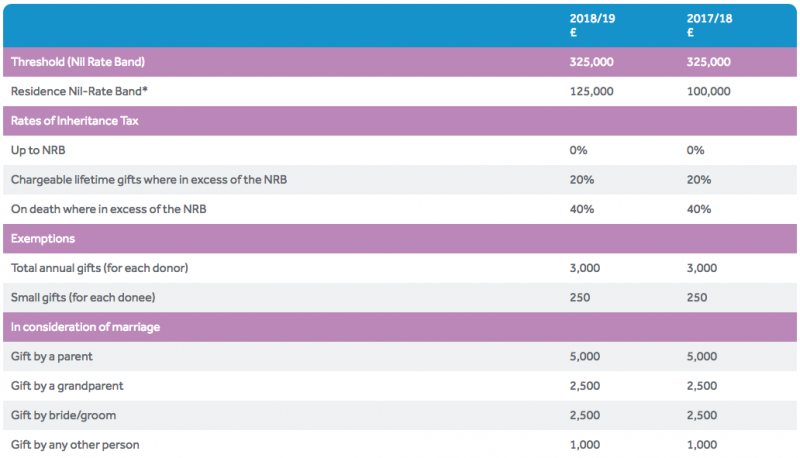

* The residence nil-rate band is in addition to the existing nil-rate band and only available when a residence is passed on death to a direct descendent. There will be a tapered withdrawal of the additional nil-rate band for estates with a net value of more than £2 million. This will be at a withdrawal rate of £1 for every £2 over this threshold.

For more information, contact one of the team today!