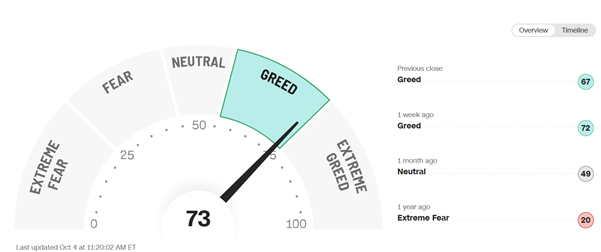

For many years, CNN have published the Fear and Greed Index as a barometer of market sentiment. It looks at a number of different factors and measures to create a consistent measure of whether sentiment is positive (Greed) or negative (Fear) and this has provided a useful visual representation of where we currently sit. The basic concept is that markets are driven by these two primordial factors, rising when investors feel greedy and falling when they are fearful.

Where are we now?

As you can see, despite a number of issues, sentiment is largely positive and certainly considerably higher than a year ago.

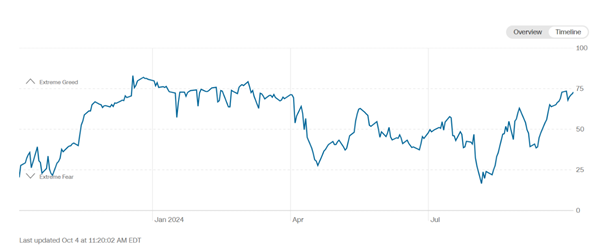

How has it behaved over the last year?

After a difficult period when inflation spiked and interest rates soared, a degree of calm has prevailed over the last year. Of course, there have been positive and negative periods along the journey, but overall, sentiment has been positive.

Why has sentiment been so positive?

It is largely a result of the waves of negative news abating. As we have long argued, inflation has come down very quickly and this has, in turn, meant that interest rates have at first peaked and then begun to fall. This is a much more positive background for economic activity and therefore for company profits and dividends. You can see from the chart above how this change in sentiment did not happen in a straight line. At one point, investors got a little overexcited that we would see interest rates quickly falling back to their historically low levels of close to zero.

Where will interest rates move to?

Interest rates in most parts of the world will fall over the next year but the big debate is currently over what level they will fall to. Current forecasts predict that they will fall in the US to around 3% and the same kind of level in the UK over the next eighteen months or so. However, having been forced to raise rates so quickly, Central Banks are likely to be much more cautious in reducing rates. Inflation, too, is forecast to fall to somewhere between 2.5% and 3% and this will be a constraining factor on where interest rates end up.

What are the potential problems ahead?

Inflation forecasts could be derailed if the current situation in the Middle East continues to deteriorate and affects global oil supply. This would, of course, also derail economic growth and further cuts in interest rates. This has already acted as a brake to some extent on positive momentum.

Coupled with this is the ongoing situation in Ukraine. It does feel that we are maybe nearer the end of this war than the beginning, as the reality that it is not a war that anyone can actually win outright becomes clearer. It still requires, however, that everyone sits around a table together and makes some very unpalatable compromises.

You haven’t mentioned the US election yet!

It was only a matter of time! Having looked like a competition between two men who would both be in their eighties by the end of the next presidential term, the campaign has been turned upside down by the decision by Joe Biden to stand down. While this has unsettled the Trump campaign, it still looks like being an extremely closely run thing and, with just a few weeks to go before the vote, it could come down to the finest of margins. This is not very helpful since, as we saw at the last election, Trump does not react well to closely run votes which he does not win. That said, while any incoming president is likely to face the same challenges, attention remains focused on technology.

What about technology?

The performance of the US stock market has been driven by a fairly narrow number of holdings, led by chip manufacturer Nvidia whose processors power the Artificial Intelligence revolution, but joined by other technology heavyweights Apple, Amazon, Meta (formerly known as Facebook) and Alphabet (aka Google). Companies are investing billions of dollars in this area, but the potential efficiencies that this spending can unlock is on a different scale. It is more like replacing halogen lights with LED lights, where there is an upfront cost, but the “payback” period is relatively short.

This has created winners and losers, even within the technology space. Right now, the investment is focused on hardware, as AI simply doesn’t run on old machines, creating a multi-year renewal cycle. However, company budgets are not bottomless, so there has been a corresponding cutback in money spent on software. However, in the next few years, businesses will want new fancy software to run on their shiny new machines, so the cycle will turn. Even within the technology space, not every road is paved with gold.

What is happening in China?

Another key event of recent weeks has been China’s decision to take dramatic action to boost its economy, aimed at increasing liquidity in the banking sector, stimulating consumer spending and revitalising the real-estate sector. The scale of the bailout is huge, but it should be looked at in the context (in investment terms) of a stock market that has gone nowhere in sterling terms for five years, even after the recent jump in response to the stimulus measures. Like many parts of the world, China is facing a rapidly ageing population, but these measures, while not guaranteeing success, at least mark a sea-change in the attitude of the authorities to tackle some of the deep-rooted problems, that might just help the global economy too.

How is Europe?

The European economy has struggled to really gain traction. Its reliance on industrial manufacturing and trade with China has seen growth stagnate. Politics, too, have been a key feature. Migrants, whether economic or political refugees, have been attracted in increasing numbers to Western Europe, creating social tensions which have manifested themselves at the ballot box. Since calling shock elections in the summer, Emmanuel Macron has created a political impasse, with vote polarising between the Hard Left and Right with the inevitable consequence that it has proved almost impossible to create any coalition of parties to form a stable government. Recent German elections have seen the rise of the AfD (Alternative fur Deutschland), especially in the former East Germany and amongst younger voters and threatens the imminent collapse of the current ruling coalition. Austria, Holland and Italy are among other countries who have seen socially democratic parties stumble in elections.

And the UK?

It is hard not to look at the recent UK election result in this context. On paper, the Labour Party have achieved an extraordinary majority, but it is built on the foundations of an opposition vote split by a resurgent Reform Party in England and a collapse in support for the SNP in Scotland, together with a first past the post voting system. Will it survive more than one term? The answer would normally be “absolutely” but in fractious times, nothing is very certain. We have a long way to go, of course, until the next election and it would be wrong to draw too many conclusions here, but a lot hinges on the forthcoming Budget (in terms of the spending headroom it creates) and then on actually delivering on the promises that have been made.

Will there be tax rises?

The short answer is yes, but the longer answer is, again, more nuanced. Any speculation on what might happen is just that – speculation. However, having ruled out changes to most of the major taxes, we are left with a smaller range of options. Capital Gains Tax may be reformed, but previous experience is that setting any rate at too high a level simply creates an environment where people do not realise gains unless absolutely necessary. Empirically, cutting capital gains might actually generate more revenue, but whether fiscal reality will triumph over political reality is another question altogether. Pensions might be subject to regulation with changes to tax reliefs and/or bringing pensions into the scope for Inheritance Tax have been mooted. However, there is a need to encourage people to make greater provision for their own retirements, so any changes need to be made with this in mind. So, the longer answer is to wait and see what changes are made in the Budget and then with good advice, act accordingly.

So, what should we do?

As we have said many times before, investing in global markets involves taking a degree of risk. We will do our job of carrying out the forensic work and ensuring that the quality of portfolios remains high and that we are invested in the kind of companies that will survive economic turmoil, but we cannot completely remove the volatility of the market which, roughly one year in four, will be down and, occasionally, substantially so.

A well-diversified portfolio of investments – by company, by sector and by asset class – remains at the heart of what we do and has, over the longer term, delivered the capital growth and income that will deliver the returns that you seek to achieve your goals. Moreover, portfolios like these have demonstrated their resilience in the most testing of times and are likely to do so in the future.

As always, if you do have any questions or concerns please get in touch.

Leave A Comment